COT Disaggregated Futures and Options Ags 05.29.18

COT Disaggregated Futures and Options Energy Softs 05.29.18

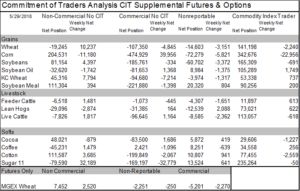

Continued short covering in Sugar 11 through the last report had Non-commercials covering 32.2K in shorts leaving a net short of 79.6K using the supplemental report. Using the disaggregated report MM shorts covered 39.7K last week and over the last 4 weeks have now covered 69.5K. The producer category sold 31.9K to them and over the last 4 weeks have added 70.4K in shorts. Swap dealers sold 10K last week and have added 23K in new shorts over the last 4 weeks. Merchant longs added 10.9K probably showing some end user demand that was caught waiting for lower prices.

Chicago wheat had funds buying 10K net on the supplemental report leaving a net short of 19.2K. Using the disaggregated report MM added 11.3K in longs bringing their monthly total to 32.4K in new longs. MM shorts covered 5.7K bringing the 4 week total to 37.6K in shorts covered. Producers over that span have been there to sell it to them adding 17.1K in new shorts last week and 57.1K over the last 4 weeks. MGEX wheat has seen MM close half of their short position over the last 4 weeks most of it coming in the recent period thru Tuesday closing 3.5K last week and total 4.8K over the last 4 weeks. Probably wish they had some of them back on over the last part of the week.

Jason Carlson

Trean Group LLC

141 W. Jackson Blvd. Suite 1201A

Chicago IL 60604